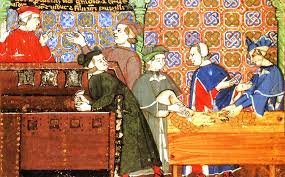

Image of banking from a medieval illuminated manuscript

By Robert Naranjo / 01.10.2008

Modern banking has its auspicious beginnings in the early to mid Middle Ages. Primitive banking transactions existed before, but until the economic revival of the thirteenth century they were limited in scope and occurrence. By the dawn of the twelfth and thirteenth centuries, bankers were grouped into three distinct categories: the pawnbrokers, the moneychangers, and the merchant bankers. But with these economic specializations came religious denunciation and backlash. However, these bankers persevered and a new industry was born.

After the collapse of the Roman Empire in the late fifth century, there followed centuries of deep economic depression, sharp deflation of prices and sluggish monetary circulation. By the end of the thirteenth century, with its economic resurgence, three classes of credit agents became distinguishable: the pawnbroker, the moneychangers and deposit bankers, and the merchant bankers. The latter were the new elite of the profession, unprecedented in antiquity and in the early Middle Ages. Wealthy commercial entrepreneurs, uncrowned governors of city-states, lenders to monarchs, relatives of popes, they were in no way embarrassed by canonical strictures. At the opposite level of the profession, the pawnbrokers were degraded successors of the early medieval usurers. They were deliberate public sinners, likened to prostitutes, and hence tolerated on earth but earmarked for hell unless they repented and made full restitution of their ‘accursed’ gains. At the midpoint, the moneychangers and deposit bankers splintered away and formed the core of the profession. They owed their respectability to manual changing, which did not involve credit. They converted one currency into another, and for that service they charged a legitimate fee. No doubt it was an open secret that in long distance exchange, entailing a delay for transportation, a premium would be worked in by doctoring up the rate of conversion; it was equally obvious that the changers’ stock in trade would be largely borrowed and lent at interest rates not openly declared. But these lapses were not public sins, and most changers lightened their guilt by including in their will a token bequest to a charity as restitution for any money gotten sacrilegiously.

A great number of medieval banking activities and their centers of operations were established in Italy. Florence, Genoa, Lucca, Venice, and Rome were some of the city-states that gave birth to these banking activities. Even thought Genoa did not become a banking leader per se in the medieval centuries, it happens to preserve the earliest notary minute books that have survived, and these books contain a fairly large number of documents showing bankers at work. Nearly all their entries involved credit transactions, but only a minority were drafted by or for bankers, who recorded routine operations in their own books and resorted to notaries only for special contracts.

It appears from the notary minutes and official records that the tenants of a banca (a bench set up in a public place for the purpose of exchanging currency) were responsible to the Genoese government for converting domestic and foreign currencies into one another as the market required, searching for forged or forbidden coins, and generally watching over the circulation. The government soon required them to keep their cash and records available for inspection, and to obtain guarantors who would be answerable for their outstanding debts up to a certain amount. In return for these restrictions, the government backed the bankers’ credibility: it recognized entries in their books as legal proof of transactions carried out through them. Somewhat later, it ordered guardians of minors to deposit the wards money in a bank.

Some citizens found it convenient to deposit some of their money in a bank account and receive a moderate interest (often camouflaged as an optional bonus) while using the account for receiving and making payments by written transfer in the banker’s book. A reliable depositor was often allowed to overdraw his account within certain limits. The banker, in turn, was entitled to invest in his own trade the deposits of his clients. A merchant created feedback credit by charging a banker (or, another merchant) with supplying foreign exchange in a foreign place, while agreeing overtly or covertly that he would waive repayment abroad in order to receive postponed payment in the currency and place of origin.

Records have survived about a merchant Genoese company involved in banking from 1244 to 1259: the Leccacorvo company. From its records, a picture of a typical merchant-banking organization can be studied. The organization was loose, almost rudimentary, but its business was not. The basic activities of the Leccacorvo company were in the field of exchange and deposit banking. Long distance contracts of exchange are the most frequent items in the series of notary minutes concerning that company. Transfer entries in the bankbooks, mostly overdrafts, are mentioned almost as often. Notary contracts were usually instruments of credit for people of means. The Leccacorvo bank did most of its business with established merchants, bankers, and government officials, including the communes of Genoa and Piacenza, the king of France and the Pope.

The notary minutes also show that the bank was steadily expanding its investments in the direction of trade. Other known investments were: fine French cloth, oriental silk, spices, furs, cotton goods, wool for the growing local industry, salt for universal consumption- all these through the usual commercial contracts of sea loan or commenda. (1)

Another Italian city conducted banking in a similar, but distinctive manner. The Tuscan city of Lucca, although overshadowed by her neighbor Florence in the later Middle Ages, was in the thirteenth century the chief center of the silk industry and the hub of a network of mercantile banking partnerships which by 1300 extended to every major European financial and commercial center. Locally, her moneychangers, at first catering primarily to foreign visitors, had moved beyond manual exchange and dealings in bullion into the area of deposit and transfer banking.

In thirteenth century Lucca, two groups of professional bankers can be distinguished. The first, the moneychangers, had already flourished for a long time. The second, merchants engaged in long-range commerce were perfecting the financial techniques and business organization upon which thirteenth century international commerce and finance were to rest. Although the process was by no means complete, the moneychangers were evolving into deposit and transfer bankers at the same time the international merchants increasingly generated commercial credit by routine dealings in foreign exchange.

The art of money changing was an esteemed one in Lucca. In 1111 the oath required of all money changers or spice dealers wishing to set up shop in the cathedral square was inscribed upon the facade of the cathedral of San Martino, where it can still be seen today. The oath, in which the changers and dealers in spices swore to commit “no theft, nor trick nor falsification”, was also visible to their customers, who crowded the cathedral square to change money or to buy exotic herbs and medicines at the portable tables and stalls set up there. Although manual exchange continued as an essential service of the moneychangers, by the thirteenth century they were adding other functions to their repertory.

The cathedral square remained the center of the changers activities throughout the Middle Ages. Outdoor business activities were conducted from a seat behind a portable table, tavola, probably covered by a canopy. The ground upon which the table stood was either owned or leased by the changer. Much of the changers business was conducted from shops ranged in houses fronting the Court of San Martino.

While the organization of the moneychangers business seems family oriented, individual changers occasionally pooled their resources in partnerships. Such enterprises were small, characteristically involving two or perhaps three changers. The term of individual partnership arrangements was usually short, three months to a year. But once two changers came together they tended to remain as such for a considerable time by successively drawing up new partnership arrangements.

Occasionally however, almost all money changers and merchant bankers had to cross the path of the major social consciousness of the Middle Ages, the church and its condemnation of interest gained from loans, referred to as ‘usury’.

The church’s condemnation of usury did not stop usurers from existing or practicing their trade. From at least the beginning of the thirteenth century, theologians and canonists distinguished usury or profit on a loan, mutuum, from such everyday transactions as contracts of association, societas; of location, locatio; and of sale, emptio. Nor did the growth of modern business methods arise from the drive to circumvent the condemnation of usury. Even when the prohibition of usury did not affect commercial practice, it did affect the spiritual state of the businessman. From the thirteenth to the fifteenth century there was a separation between the usurer-pawnbroker and the merchant banker. Nevertheless, it took a long time to distinguish between the merchant and the usurer; and with good reason, if the merchant practiced methods tolerated by the church, he usually practiced others which it branded and condemned as usury.

The documentary evidence supporting the church’s stand against usury can be found in the course of the long but divided thirteenth century (ca. 1180 to ca. 1280), when the monetary economy was undergoing its great expansion. The eternal and terrestrial fate of the usurer was decided by the condemnations of the general councils: Lateran III in 1179, Lyon II in l274, and Vienna in 1311.

The Second Lateran Council (1139) had condemned usury as “ignominious.” Lateran III went further: canon 25, quia in omnibus, erected three capital decisions: (1) excommunication for open usurers, the church’s categorization of the usurer during this period, thus excluding him from the Christian community; (2) refusal of inhumation in Christian ground; and (3) interdiction of usurers’ offerings- thus excluding them from the essential practice of medieval public beneficence.

In 1214, the canon Usurarum of Lyon II- extended the preceded condemnations to foreign usurers such as the Sienese and Florentines in England, and those called pretatores in Italy, cahorsini in France, and renovatores in Provence.

The isolation of the usurers was completed by canon 15 of the Council of Vienna (131l}, which extended excommunication to those who authorized usury or protected usurers: legislators authorizing a minimum usury rate and public authorities who utilized it, princes and public powers protecting usurers, and confessors giving absolution to unrepentant usurers.

These religious proscriptions made the outlook of the usurers very bleak. Against him aligned one ideological concern of the moment: work. Work was emerging from a long malediction inherited by archaic societies and sanctioned by Genesis, where work was man’s punishment for original Sin. Around the middle of the twelfth century, work became a positive virtue and a touchstone of the socio-religious value system. Everyone doing work expected to be justly compensated, to receive a profit for performing a duty. However, the usurer is the merchant banker who receives the most shameful profits of all, since lending at interest brings him money without his having worked. The usurer wants to make a profit without any work at all and even while sleeping, which is against the teaching of the church: “You will earn your bread by the sweat of your brow.” The usurer found himself, in time, linked to the worst ‘evildoers’, the worst occupations, the worst sins, and the worst vices; for he was an evildoer of the highest degree, a pillager and robber. Secular law did not punish usurers by hanging them, as it did highwayman and robbers of common law, because usurers did not disturb the public order and sometimes were even useful to the public: but the church pursued them like all robbers because they lived off their usury.

The second degrading occupation often mentioned in relation to usury was prostitution. The open usurer, like the prostitute, practiced a public occupation that was both well known and shameful. Still, with prostitutes there were extenuating circumstances; they work even if their work is humiliating, and also, ownership of the money actually passed from the client to the prostitute, and this is not the case with the usurer’s loan to the debtor.

If while living, the usurers’ ordeal was intense, death was not going to bring him peace. Because his fate is to die impenitent, his is the atrocious death of the great sinners before who awaits hell. Then comes the problem of the burial place. The interment of the usurer is tragic. Normally he is refused a Christian grave, in compliance with the prescriptions of the third Lateran Council. But if by error or ignorance there are churchmen who give him a Christian funeral, either his interment is disturbed by ‘diabolic incidents’, or it is said that only a simulacrum of the corpse which is interred, the true burial place of the usurer being hell.

In terms of eternal salvation, which was the essential concern for the great majority of people in the thirteenth century (including usurers), the situation was dramatic. The choice was not just between heaven (unthinkable for the majority of usurers) and hell. A third path to eternity opened up at the end of the twelfth century: purgatory, excised from hell to become an antechamber of heaven.

Only a belief in purgatory and the practices to which it gave rise could permit the exigencies of religion to be thus adopted, by the devices of reparation and the reduction of suffering, to the complexities of a new reality. Certainly not everything was won for the usurer at the beginning of the thirteenth century. In the Divine Comedy there are no usurers in purgatory: they are all in hell, at the end of the seventh circle in the rain of fire. They are all portrayed as sad people, each with a purse hanging perpetually from their neck. But with the beginning of the thirteenth century new ideological possibilities emerged and with the birth of purgatory, the dawn of banking begins.

Notes:

(1) Commenda (recommendation), a one time loan issued by the lender to a traveling faction. All the risks involving the capital were carried by the lender and no claims could be filed against him by third parties coming in contact with the borrower. The lender took a hefty share of the profits (usually three quarters) with the remaining going to the borrower.

Sources:

Ashley, William J. An Introduction to English Economic History and Theory. London 1888.

Baldwin, John w. Masters, Princes; and Merchants: the Social Views of Peter the Chanter and His Circle. Princeton, 1970.

DeRoover, Raymond. Cambridge Economic History of Europe 3. Cambridge, 1963.

Fichtenau, Heinrich. The Carolingian Empire, trans. Peter Munz. Oxford, 1957.

Lopez, Robert S. The Commercial Revolution of the Middle Ages. Englewood Cliffs, NJ. 1971.

Pentru a putea adăuga comentarii trebuie să fii membru al altmarius !

Alătură-te reţelei altmarius